It’s 4pm on a Saturday afternoon. I check my mailbox and see an unfamiliar envelope. I open it. I stop and stare at the document, attempting to piece together the words in front of me. My name. Taxes. State of New York. Civil Warrant. Time freezes. The word warrant flashes over and over. My son, who is in my arms, stares at me, a witness to the swift change in my body energy—from joyful to stunned.

Feeling dizzy, I enter my Bed-Stuy apartment. My housemate asks me what is wrong. I say, “Nothing,” and cram the warrant into my bag before continuing to recall my favorite moments from the Adrian Piper exhibit at MoMA that I’d visited earlier in the day. Piper’s A Synthesis of Institutions, 1965–2016[1] is a four-decade survey of Blackness as a daily experience / as it interacts with the violence of white supremacy. Out loud I begin to unpack the chilling and beautiful elements of the exhibit. Behind the casual conversation I am asking myself a litany of questions: Why did I cram the warrant in my purse? Why did I hush it away? Why do I feel ashamed? How does debt operate in our daily lives? I thought about the ephemera in the exhibit. Piper uses journals, video, recordings and documents as interventions, to trace the lineage of her Blackness as well as the white violence she encounters. For a brief moment, I imagine the warrant blown up wall size in the MoMA. I want it visible. I want people to stare at it and talk about it. This fantasy leads me to the question: How do we get people to talk about the oppressive nature of debt when there is so much stigma and shame attached to owing?

For those of us who belong to marginalized groups, debt and systems of owing are one of the many ways we constantly navigate our survival. Being in debt is exhausting. It robs people of their energy, their joy, and their ability to sleep at night. For many, debt has led to divorce. For others, it has led to death, as is the case of the string of taxi medallion drivers who killed themselves in NYC.[2] Therefore, I believe we should talk about it, expose it, create art about it, and organize against aggressive collection practices and policies in our communities as often as possible. Maybe these actions will change the system. At minimum, perhaps we will release the stress we hold in our bodies because of the debts we are constantly managing. Liberation from debt begins in the body because that is the place capitalism seeks to separate us from ourselves and each other, hoping that we will reconnect with ourselves and each other by way of consumerism instead.

I am a queer Black woman. I am politically interested in the topic of debt on all scales—from personal to political debt. I define debt specifically in terms of economics. I also define debt more broadly. It is a liminal space of owing between two parties where one wields a tremendous amount of colonial power over the other. Therefore, to me, debt is profoundly personal and inherently political. I am a first-generation college graduate who received a formal education at private, predominantly white institutions. I carry a tremendous amount of educational debt: $260,284.33 in federal student loans in addition to an ever-accruing high interest loan in the amount of $14,000 to Sallie Mae. These financial burdens are a part of my daily life and impact every decision I make. As a result, I am constantly thinking about how systems of owing impact the lives of the most marginalized. As a writer, I utilize my craft as a tool to make the invisible nature of oppressive networks of power visible. My education, my interests, my experiences have yet to shield me from the economic vulnerabilities and disparities that continue to exist in the daily lives of Black Americans. How I ended up with a warrant is similar to the way thousands of people[3] across the United States also end up with warrants. I have a bill. I don’t pay it. Then the government gets involved by escalating the matter and criminalizing the person who owes as a collection tactic. Since I think about and am constantly researching debt as a system of oppression, I intellectually know that the warrant I received was a scare tactic—but that knowledge doesn’t make it any less scary.

In my case, I filed my taxes on time. I received a refund. Ninety days later, I received a letter stating that the federal government had overpaid me, in terms of my refund. This was fancy language for them making a mistake—as a result, they requested a portion of the refund back. It was laughable that they made the mistake and infuriating that it was my responsibility to get it back to them via a notice ninety days later. Of course, the money had already been spent. What happens next is what happens to so many marginalized people: the bill gets lost in the day-to-day chaos of our lives. Between the high cost of rent, food, and transportation in an increasingly gentrified Brooklyn, attending grad school, working part time as an adjunct professor in New Jersey, getting pregnant, and having a baby, this bill got lost in the shuffle and eventually I forgot about it.

Ironically, I received the warrant two years after the original notice, just as I was returning to work from my (unpaid) maternity leave. Luckily, I was able to pay it off with my first postpartum paycheck. Being the mother of an infant, it was better to sacrifice a full check of pay than to deal with courts and penalties, and I wasn’t certain if a civil warrant would show up on my driver’s record. I delayed paying smaller bills and went without a few basic needs during that period until my next paycheck. I live in a predominantly Black working class and poor neighborhood. I couldn’t help but look out my window at my street and at my neighbors and think: I will survive this moment, but what happens when people don’t have resources to pay off debt in one lump sum? The reality is that most do not.

When the court systems get involved with debt collection, it escalates quickly. The collection process starts by sending a letter demanding payment and assessing additional penalties and interest. Normally, after multiple letters and taxpayer inaction, harsh collection tactics begin. Below are a few of the methods that may be used by the taxing authorities to collect unpaid taxes.

- Tax Lien: A tax lien is the government’s claim on the taxpayer’s property. The existence of the lien ensures that they get first rights to your property over other creditors.

- Wage Garnishment: The taxing authority will contact your employer and demand they withhold a certain percentage of your pay to cover unpaid taxes.

- Bank Levy: The tax authorities will contact your bank and demand a hold be put on the funds that are in the account and then seize the funds to cover the unpaid tax liability.

- Property Seizure: The tax authorities may seize assets such as your car, boat, house or other asset of value that can be sold to cover the unpaid tax liability.

- Jail time: Incarceration is possible through loopholes in the criminal justice system. Depending on the circumstances, taxing authorities can have a taxpayer arrested and put in jail.

While according to most court systems the process of clearing these debts is straightforward and fair, the truth is that once people get locked into these court judgements, it takes years to free themselves from it. When you are already stretched thin economically, a debt judgement becomes a full-blown crisis.

In the United States of America, no one goes to jail for owing taxes, technically. Debtors’ prisons were abolished by Congress in 1833. And yet we know that the poor and marginalized can go to jail because the penalization of the debt will overflow into their already vulnerable lives. It’s estimated that more than one million consumers each year receive such letters threatening criminal prosecution and jail time if they do not pay up. But a review of company practices has documented that letters often falsely misrepresent the threat of prosecution as a means of coercing payments from unknowing consumer.[4] While there are no debtor’s prisons, there are still prisons. For those of us whose debt does not pull us into the criminal justice system, our cultural norms of individualism certainly guarantee that our debt will imprison us in our minds with thoughts of shame and personal failure.

I am not alone in the anxiety I experienced. In 2009, a spokesperson for the U.S. Internal Revenue Service estimated that 8.2 million Americans owed over $83 billion in back taxes,[5] penalties and interest (approximately $10,000 per person). For Black and poor people already struggling to eat and pay rent or mortgages, back taxes are just one of the many government debts that drive them into financial crisis. In addition to the low-hanging fruit of government- specific debts (think traffic tickets, bail bonds, court fees and the like), the court system is often leveraged by aggressive debt collectors to encourage repayment of consumer debt such as credit card debts, medical debts, and student loan debts.[6] Then there are other debts, such as personal loans, cell phone bills, utility bills, bank overdraft charges, auto loans, payday loans. This is the short list.

Mizuki, Photo by Flickr user, Paul Sableman, Photo by User:LittletT889. Accessed via Wikimedia Commons.

In 2015, ProPublica released a startling report titled “The Color Of Debt.”[7] The report was the product of an ongoing investigation into several debt collections agencies that were aggressively using the court systems to sue almost every resident in the predominantly Black city of Jennings, Missouri. Not only are residents in Jennings feeling the squeeze of low wages, along with often predatory loan agreements, but Black families are living out the impact of “generations of discrimination [which] have left [them] with grossly fewer resources to draw on when they come under financial pressure.” In Jennings, which is a small community, no one talked about the lawsuits. Even the mayor at the time, also a resident of Jennings, was being sued. The shame of debt and the generational inequality that many of these families face silenced them. Creditors also seized at least $34 million from residents of St. Louis’ mostly Black neighborhoods through suits filed between 2008 and 2012, ProPublica’s analysis found.

In addition to adhering to federal laws, New York State has its own debt collection regulations. Court judgements are served with civil warrants and subpoenas requiring attendance at depositions. Failure to comply with a subpoena is punishable by contempt of court, and the court may issue a warrant directing the sheriff to bring the individual to court.[8] While New York has recently amended its debt collection regulations to offer more consumer protection, the allowed collection strategies still often escalate to court systems, which has profound impact on the daily lives of individuals, many of whom are already being squeezed by high rents, gentrification, and displacement in an increasingly expensive city like New York.

Think about the neighborhood of Bed-Stuy and communities with similar profiles. According to the “Economic Snapshot of the Bedford-Stuyvesant Neighborhood” report, Bedford-Stuyvesant has been a center of Black and African-American culture since the 1930s, when it emerged as the second-largest Black community in New York City.[9] With the neighborhood rapidly changing due to gentrification, the long-time residents are not benefitting from the boom of real estate development in the neighborhood. Bed-Stuy, along with its bordering neighborhoods, Canarsie, Flatlands, and East New York, have the most one-to four-family homes in the borough with unpaid debt, including property taxes, water bills and other charges, according to the Center for NYC Neighborhoods.[10] When you begin to trace the history of inequality and systemic discrimination in these neighborhoods, it becomes increasingly clear that “a history of redlining, blockbusting and predatory lending have created conditions where the homeowners [within these neighborhoods] have fewer assets and more expensive mortgages than white families in New York City’s other major homeowner areas like South Brooklyn and Staten Island.”[11] The numbers show that some neighborhoods are more likely to be targets for predatory practices, aggressive collection policies and subprime lending. It is no accident that some neighborhoods are more vulnerable than others—it is the direct result of poverty and systemic racism that has plagued these communities for decades.

Debt is more than an individual burden, it is a generational cycle that reveals the inequalities families face over time. It is also often the predictor of the inequalities families will face in the future. So what can we do about it? What decolonial practices should we dive into? What hope is there, if any? Can we abolish debt and its oppressiveness? It is important for community members, artists, writers, and organizers to gather around this topic. It is universal. It impacts all of our lives intersectionally. The power of Adrian Piper’s exhibit is not only that it creates space for dialogue, but that it creates space to call out complicity and oppression. Piper’s work operates as a witness and a warning—this itself creates much-needed resistance. The phrase “everything will be taken away” repeats itself throughout the exhibit. While this phrase is ominous and open to multiple interpretations, it is clear that Piper is addressing viewers with and without privilege to challenge ideas of permanence—or, as many older Black church saints utter, “This too shall pass.” According to Piper, “[The] Everything series[12] evolved from [her] need to cope with the loss of [her] illusions about the United States.” For Piper, seeing the illusions of race and equality in our daily lives allows us to see the forces operating behind the cultural practices we hold on to.

If we organize around debt we can create opportunities to see beyond illusions as well. Coming together and speaking out is one of the most important aspects of debt resistance. This is not a new practice. Many state and local communities offer debt clinics. These spaces focus on how individuals can be better debtors. They explain the legal entity of debt. They often connect individuals and families with financial advisors, along with other community resources and programs. This is helpful and necessary, but it is only the beginning of organizing against debt oppression.

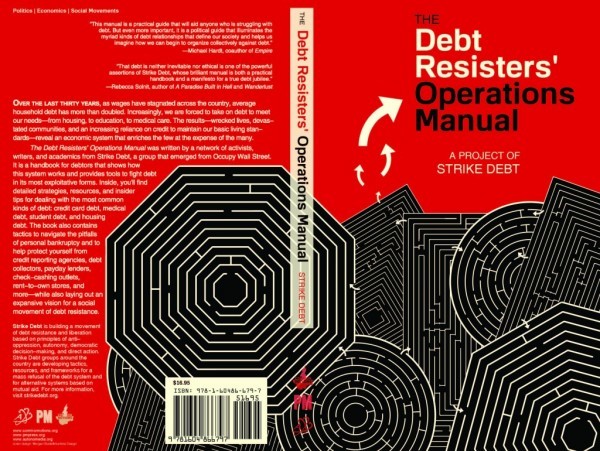

Guides like the The Debt Resistors’ Operations Manual[13] are critical reading for anyone in debt who needs not only personal strategies but a systemic view of how debt operates in our lives. This is information you will not find at a community debt clinic that is run by your local city or town office of finance. It covers, in detail, strategies, resources, and insider tips for dealing with some of the most common kinds of debt, including credit card debt, medical debt, student debt, and housing debt. It also contains tactics for navigating the pitfalls of personal bankruptcy, as well as information on how to be protected from credit reporting agencies, debt collectors, payday lenders, check-cashing outlets, rent-to-own stores, and more. Additional chapters cover tax debt, sovereign debt, the relationship between debt and climate, and an expanded vision for a movement of mass debt resistance.

Strike Debt[14] is building a debt resistance movement. Strike Debt is an offshoot of the Occupy movement, and follows many of the principles that were adopted by Occupy participants from other non-hierarchical movements. In my survey of the landscape of organizing around debt, I believe Strike Debt has created a great foundation, and that there is room to expand the work. The work is universal but must also be intersectional. Engaging people of color, queer people, those who are differently abled, those who are immigrants, those who are poor or working class, those who are undocumented and so on requires different strategies. This means we need diverse groups of organizers with innovative approaches to reach those who are all too often forgotten. Groups like Decolonize This Place,[15]New Economy Coalition,[16]Ni Una Menos,[17] and Chinatown Art Brigade[18] are all helpful examples on the possibilities of decolonial coalition work. Debt organizers can learn from these groups to reach for intersectional ways of operating in communities. The goal of organizing around debt is to first create a decolonial space—meaning that when talking about money, debt and race, human experience is the center of the conversation, not capitalism.

When I tell people I am interested in debt—in talking about it, writing about it, creating art about it, reading about it, etcetera, they often assume I am continually stressed in dealing with such a dense topic all the time. My experience is quite the opposite and this is why: capitalism seeks to disconnect us from our bodies through a violent process of dehumanization. According to capitalism, we are not people, we are numbers. We are laborers. We are cogs in an economic machine. Debt similarly creates ambiguous networks of relating. Debt, which begins between two parties, often explodes to include a multitude of third party entities, which displaces accountability and dehumanizes all parties involved. Therefore, it feels good to have conversations where we map the chain of interactions. This helps to remind us that we are human and often caught within economic systems that have already calculated the role we will play in the economy.

Whether you have $100 dollars in debt or $1 million dollars in debt, there are third parties who benefit from viewing us as accounts because they earn money from our late payments, interest, credit ratings, and the supposed moral failures of our inability to pay. The problem is that debt is not a moral issue—it is an economic one at best and a colonial one at worst. The process of dehumanization where you and I become credit report numbers to be tallied is the same market dehumanization that carried Africans to the Americas as enslaved property; that justified the genocide of Indigenous people who already lived in America. When people become tallied within a market place, ethnic cleansing, genocide and crimes against humanity are not far behind.

We are humans, not robots, numbers, or simply laborers. Our bodies want freedom. We become a part of the economy we live under whether we choose to or not. Liberation is at the root of our deepest desires. The act of talking about debt constantly allows me to feel my emotions about the matter, express those feelings, engage with community, and reconnect with myself and others. Talking about it removes me from the silos of isolation and shame that debt creates through its vastly displaced networks.

Talking about debt is cathartic. Organizing against debt is cathartic. Coming together and speaking out is pleasurable. While I can’t promise that we will burn down all the systems of oppression, I can assure you that a guided conversation with a skilled facilitator or organizer or artist can be life-changing—even, dare I say, liberating. We must seek out decolonial practices in organizing around debt. We must dream beyond what other organizers have dreamt of. We must leverage existing resources and tap into new economies. We must recognize that the policies and practices that support debt must be organized against. All of this begins by coming together and speaking out. This will save our lives.

[1] “Adrian Piper: A Synthesis of Institutions, 1965–2016,” March 31–July 22, 2018, The Museum of Modern Art. https://www.moma.org/calendar/…

[2] “Another Taxi Driver in Debt Takes His Life. That’s 5 in 5 Months.” By Nikita Stewart and Luis Ferré-Sadurní, The New York Times, May 27, 2018. https://www.nytimes.com/2018/0…

[3] “Some U.S. borrowers jailed over civil debts, ACLU report shows.” By Kevin McCoy. USA Today. Feb 21, 2018. https://www.usatoday.com/story/money/2018/02/21/some-u-s-borrowers-jailed-over-civil-debts-aclu-report-shows/354867002/

[4] “Debtors’ Prison in 21st-Century America.” By Whitney Benns and Blake Strode. The Atlantic. February 23, 2016. https://www.theatlantic.com/business/archive/2016/02/debtors-prison/462378/

[5] “Back Taxes.” Investopedia. https://www.investopedia.com/terms/b/back-taxes.asp

[6] “Debt Collection Laws.” SmithMarco, P.C., 2014. http://protectingconsumerrights.com/debt-collection-problems/types-of-debt/credit-card-debt-collection/

[7] “The Color of Debt: How Collection Suits Squeeze Black Neighborhoods.” By Paul Kiel and Annie Waldman, ProPublica, October 8, 2015. https://www.propublica.org/article/debt-collection-lawsuits-squeeze-black-neighborhoods

[8] “A Pound of Flesh: The Criminalization of Private Debt.” American Civil Liberties Union, 2018. Union. https://www.aclu.org/report/pound-flesh-criminalization-private-debt

[9] “An Economic Snapshot of the Bedford-Stuyvesant Neighborhood.” Office of the New York State Comptroller, September 2018. https://www.osc.state.ny.us/os…

[10] “Compounding Debt Race, Affordability, and NYC’s Tax Lien Sale.” Center for NYC Neighborhoods, November 1, 2016. https://cnycn.org/wp-content/uploads/2014/02/CAH-tax-lien-sale-report-final.pdf

[11] “Compounding Debt: Race, Affordability, and NYC’s Tax Lien Sale.” Coalition for Affordable Homes, 2014. https://cnycn.org/wp-content/uploads/2014/02/CAH-tax-lien-sale-report-final.pdf

[12] “Adrian Piper.” From “The Wall in Our Heads: American Artists and the Berlin Wall,” curated by Paul M. Farber. Haverford College, 2015. http://exhibits.haverford.edu/thewallinourheads/artists/adrian-piper-american-born-1948/

[13]The Debt Resistors’ Operations Manual. A Project of Strike Debt / Occupy Wall Street, September 2012. http://strikedebt.org/The-Debt-Resistors-Operations-Manual.pdf

[14] Strike Debt website. http://strikedebt.org/

[15] Decolonize This Place website: http://www.decolonizethisplace.org/Artforum, Summer 2018. https://www.artforum.com/print…

[16] New Economy Coalition website: https://neweconomy.net/

[17] Ni Una Menos.” Wikipedia. https://en.wikipedia.org/wiki/Ni_una_menos

[18] Chinatown Art Brigade website: http://www.chinatownartbrigade.org/